China Deals Barometer Report: Dec was the second best month for PE-VC dealmaking in 2023

Investors in Greater China-based startups made a dealmaking sprint in December as a total of 248 deals were sealed in the last month of 2023, up 13.2% from November. The deal count was the second highest in the year after August when 257 deals were sealed.

Dealmaking last month was also higher than in December 2022, when 234 transactions were sealed, according to proprietary data compiled by DealStreetAsia.

However, the funds raised in December 2023 were down 9% on a month-on-month basis and fell 40.1% on a year-on-year basis, to around $3.3 billion, owing to the scarcity of big-sized transactions.

In total, 2023 saw startups conclude 2,589 deals, up 13.1% from 2022. The total capital raised, at $52.1 billion, was 2% less than in 2022, and far below 2021’s record of $87.4 billion.

Chip-making firms seal megadeals

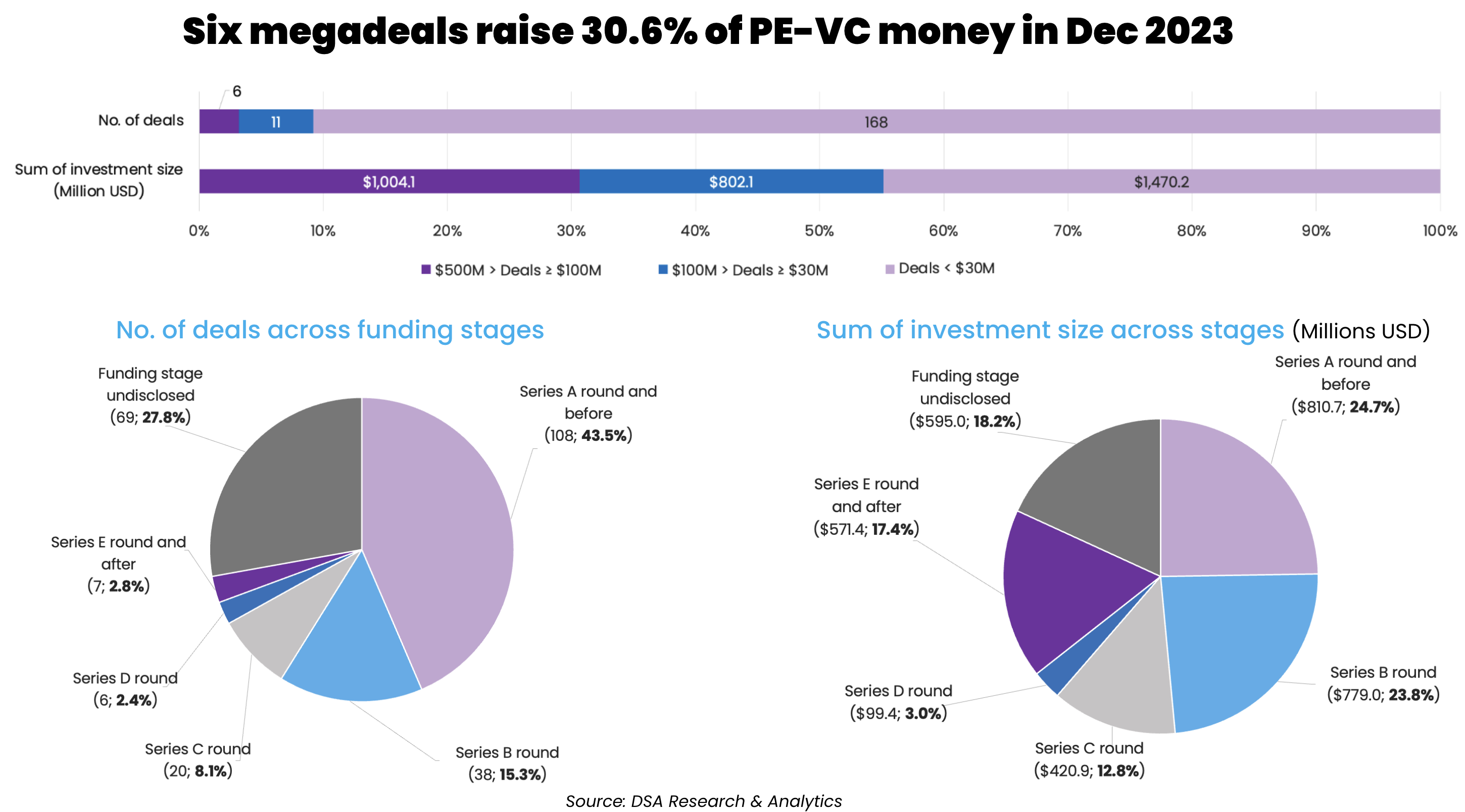

December saw the completion of six megadeals—or transactions worth at least $100 million—that cumulatively raised over $1 billion, or 30.6% of the month’s total financing. In comparison, there were six megadeals in November that cumulatively raised nearly $1.7 billion, or 46.3% of the month’s total financing of $3.6 billion.

The biggest venture deal in December was sealed by semiconductor material maker Synlight Semiconductor, which raised 1.5 billion yuan ($211.9 million) in a Series F round led by two Chinese national funds.

Ranking second was a $210-million extended Series E funding round raised by Hong Kong’s travel tech unicorn Klook. Led by US-based VC firm Bessemer Venture Partners, the round saw the participation of BPEA EQT—the Asian private equity unit of Swedish investment firm EQT, which has now rebranded as EQT Private Capital Asia—as well as Seoul-based Atinum Investment and Shanghai-based Golden Vision Capital.

In another megadeal, snack shop chain Lingshi Henmang sealed a 1.05 billion yuan ($147.3 million) strategic investment round that counts two local snack makers including Yankershop Food and Haoxiangni Health Food as investors. The deal came at a time when consumer brands in general had a hard time fundraising.

The remaining three megadeals were completed across the sectors of aerospace, pharmaceutical, and automobile.

Series A and earlier funding stages continued to be investors’ favourites—a total of 108 early-stage deals were sealed accounting for 43.5% of the month’s total deal volume.

The late-stage investment scene showed a slight recovery —with the completion of seven deals at the Series E stages or after, accounting for 2.8% of the month’s total deal count. Only one late-stage transaction was sealed in October and three in November.

List of megadeals (December 2023)

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| Synlight Semiconductor | Baoding | 211.9 | F | Shenzhen Capital Group, Jingjinji Industry Synergistic Development Investment Fund | Baoding National High-Tech Industrial Development Zone Venture Investment, Hebei Industrial Investment Strategically New Industry Development Centre | Semiconductor | N/A |

| Klook | Hong Kong | 210 | E+ | Bessemer Venture Partners | BPEA EQT, Atinum Investment, Golden Vision Capital, Krungsri Finnovate (under Bank of Ayudhya), Kasikornbank Financial Conglomerate, SMIC SG Holdings | Travel & Leisure | Travel Tech |

| Lingshi Henmang | Changsha | 147.3 | Strategic Investment | Yankershop Food, Haoxiangni Health Food | Retail | N/A | |

| Galactic Energy | Beijing | 154.2 | C, C+ | Ziyang Major Industry Equity Investment Fund | Founder H Fund, Langfang Linkong Fund, Bengbu Zhongcheng Venture Capital | Aerospace | Space Tech |

| Avistone Biotechnology | Beijing | 141.3 | B | IDG Capital, CMG-SDIC Capital | Yanchuang Capital, Cathay Capital, Bain Capital | Pharmaceutical | Biotech |

| OSWELL | Zhuji | 139.4 | B | VAST Capital | Automobiles & Parts | Electric/Hybrid Vehicles |

Semiconductor top sector, travel tech heats up

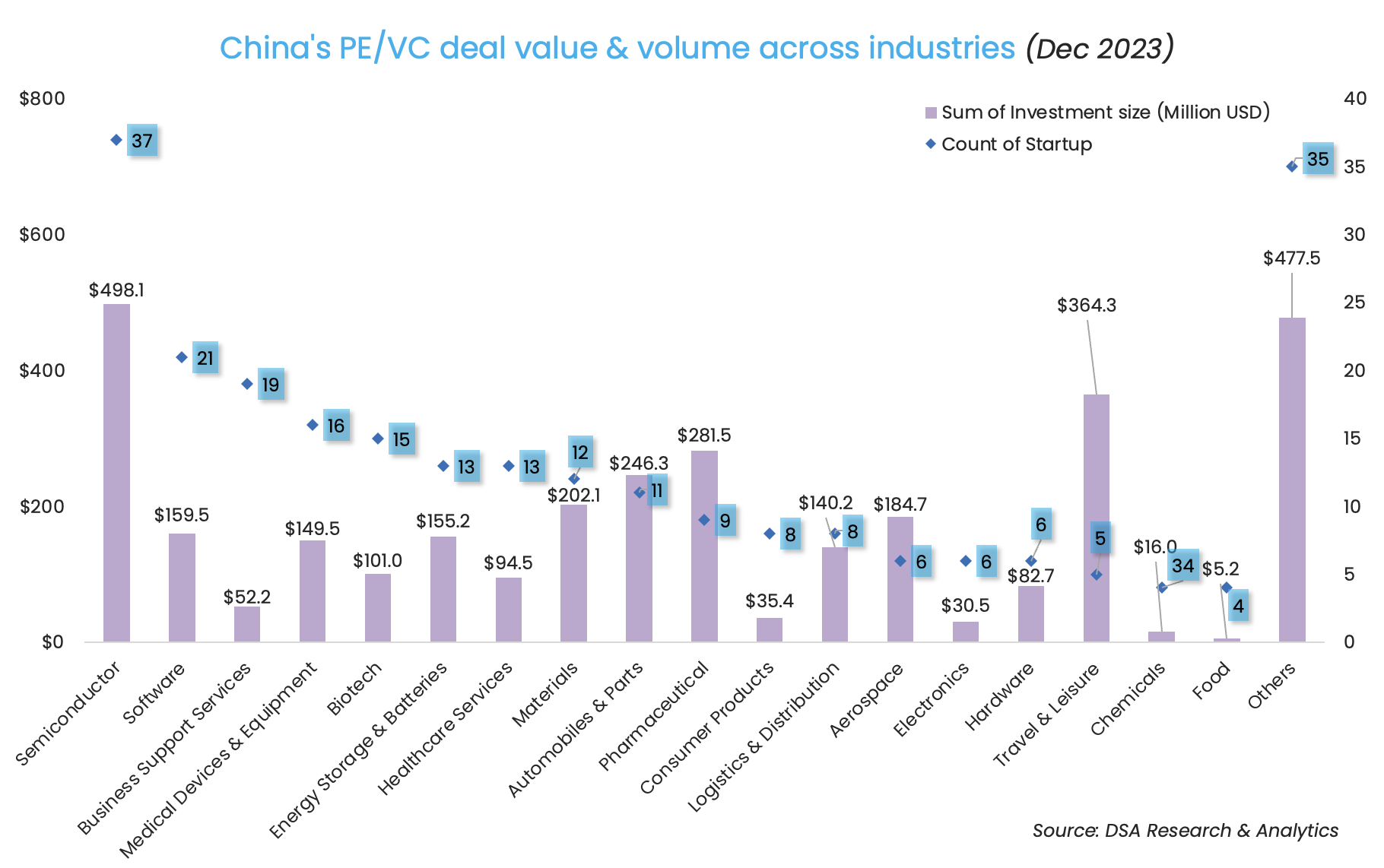

Chip-making firms continued to ride the funding tailwind. The semiconductor industry ranked first in terms of deal count and deal value (see chart below).

There was a notable interest in travel tech companies in December. As Asia Pacific’s tourism industry witnessed a significant recovery in 2023, analysts predicted that international tourism visits across most APAC economies are set to hit pre-pandemic levels in 2024.

The tourism rebound bodes well for the travel & leisure sector, which saw five firms raising a total of $364.4 million in December. This includes two megadeals—by Klook and Lingshi Henmang.

In the case of Klook, the Hong Kong-based unicorn booked an annual gross booking value of $3 million in 2023, which was up threefold from 2019. Meanwhile, it also hit “overall profitability” for the first time in 2023, it had said without divulging details.

In comparison, only one travel & leisure deal was logged in November—Hong Kong-based sports entertainment firm Rising East Asia League sealed its seed funding round from the AEF Greater Bay Area Fund, which is managed by Gobi Partners GBA.

Shenzhen Capital Group tops investor list

Shenzhen Capital Group, an investment firm based in southern China’s Shenzhen City, climbed up the investor list in December. As the most active investor in the month, the state-affiliated firm injected $423.5 million into nine startups.

Set up in 1999 by the Shenzhen municipal government and commercial shareholders, the firm oversees 464 billion yuan ($65.1 billion) in assets under management (AUM). It currently manages 180 private equity funds, 16 funds of funds (FoFs), and 20 specialised funds including real estate funds and private investment in public equity funds.

The second most active investor by deal count was Chinese automaker SAIC Motor and its affiliates. The group splurged $115.4 million across seven startups in December. In March 2023, the state-owned automobile manufacturer announced the first close of its automobile-focused fund at almost 3.4 billion yuan ($488.1 million). The fund, managed by SAIC Motor’s private equity (PE) investment platform Shang Qi Capital, aims to raise a total of 4 billion yuan ($574.2 million).

December also saw a slew of China-focused investors hitting fundraising milestones, including the likes of CTC Capital, Addor Capital, CDH VGC, Panlin Capital, QF Capital, and Hillhouse-backed Gaolu Group, as they gear up dry powder for the new year.

Most active investors in China (December 2023)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Shenzhen Capital Group | 9 | 423.5 | 4 | 5 |

| SAIC Motor & affiliates | 7 | 115.4 | 5 | 2 |

| IDG Capital | 6 | 193.3 | 3 | 3 |

| CAS Star | 6 | 3 | 3 | 3 |

| Legend Holdings & affiliates | 5 | 151.6 | 3 | 2 |

| Qiming Venture Partners | 5 | 138.7 | 4 | 1 |

| Shunwei Capital | 5 | 53.2 | 2 | 3 |

| CoStone Capital | 5 | 45 | 1 | 4 |

| Cathay Capital | 4 | 197.2 | 0 | 4 |

| Xiaomi Corp | 4 | 101.1 | 1 | 3 |

| Sinochem Capital | 4 | 0 | 1 | 3 |

| CMG-SDIC Capital | 3 | 155.8 | 2 | 1 |

| China Construction Bank & affiliates | 3 | 155.1 | 0 | 3 |

| GL ventures | 3 | 107.4 | 1 | 2 |

| NIO Capital | 3 | 99 | 1 | 2 |

| China Merchants Group & affiliates | 3 | 94.4 | 0 | 3 |

| Oriza Holdings and affiliates | 3 | 83 | 1 | 2 |

| CICC Capital & affiliates | 3 | 78.7 | 0 | 3 |

| Jolmo Capital | 3 | 30.5 | 0 | 3 |

| Fortune Capital | 3 | 30.5 | 2 | 1 |

| Tsinghua Holdings Capital (TH Capital) | 3 | 29 | 0 | 3 |

| South China Venture Capital | 3 | 17.5 | 1 | 2 |

| Nuo Yan Capital | 3 | 17.5 | 2 | 1 |

| Nanshan SEI Investment | 3 | 16 | 0 | 3 |

| CDH Investments | 3 | 14.5 | 0 | 3 |

| THG Ventures | 3 | 0 | 0 | 3 |

Note: In our monthly analysis for December 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

- Addor Capital

- CDH VGC

- CTC Capital

- Gaolu Group

- Panlin Capital

- QF Capital

- saic motor

- Shenzhen Capital Group

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup funding hits five-month high of $1.16b in Dec

Startup fundraising in Southeast Asia ended 2023 on a positive note as privately-held companies in the region managed to scoop up $1.16 billion in funding in December, a five-month high.

Venture Capital

India Deals Barometer Report: Startup fundraising springs back in December to touch $1.1b

After a mostly gloomy 2023, Indian startups ended the year on a high note as private equity and venture capital investments more than doubled to $1.1 billion in December from $483.6 million in November, according to proprietary data compiled by DealStreetAsia.