Halfway through 2024, the venture capital landscape in Southeast Asia remains parched. The funding drought that has plagued the region for the past two years shows little signs of letting up, leaving startups thirsting for investment.

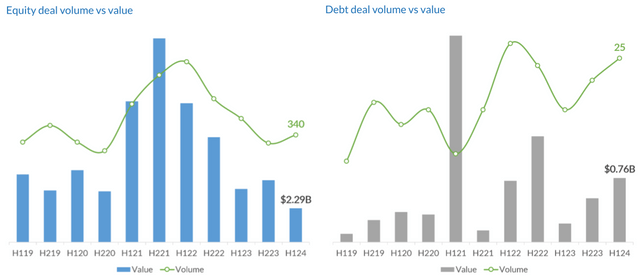

The total volume of equity funding in Southeast Asian startups declined in the second quarter, reversing the upward trend of the previous two quarters. Overall, startups completed 340 deals in the first six months of this year, down by 13% year-over-year (YoY), according to DealStreetAsia DATA VANTAGE’s latest report SE Asia Deal Review: Q2 2024.

More concerning is that the total value of proceeds, which stood at $2.29 billion in H1 2024, marking a 36% YoY decline and the lowest level in over five years.

Indonesia is among the worst performers in the region as funding activities in the country extended their gradual decline, hitting a new low in the second quarter as deal volume dropped to the lowest level in more than five years.

Traditionally the second-largest market for venture funding until the end of last year, Indonesia was outperformed by the Philippines and Thailand in the second quarter, raising only $52 million, also the lowest in more than five years.

Even as there was limited access to debt market activities, the report identified at least 25 deals involving loans with a total value of $757 million, representing a YoY growth of 39% and 246%, respectively.

Seed-stage resilience

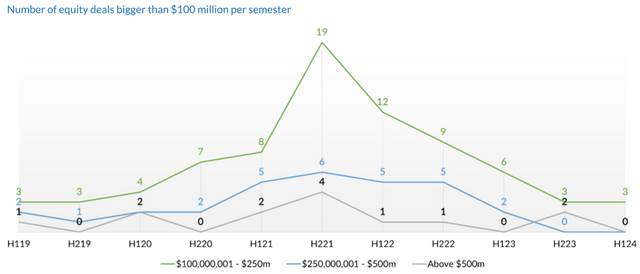

Breaking a long-standing trend, early-stage startup funding surpassed late-stage funding in the first semester (H1 2024), marking a significant shift from the past five years when late-stage startups typically attracted more capital.

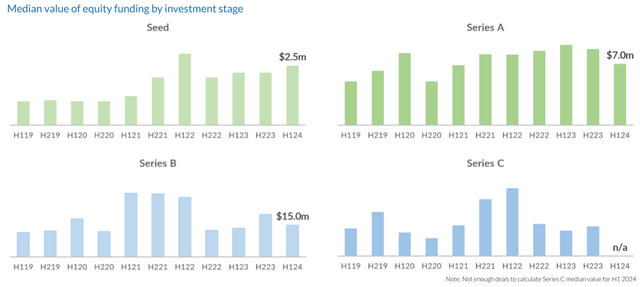

A closer examination of early-stage deals reveals that seed funding remains resilient, although overall performance still falls far below those seen from mid-2021 to mid-2022.

In terms of volume, seed startups completed 58 deals in the second quarter, roughly matching the previous quarter, and concluded the semester with 115 deals, representing a relatively mild 5% YoY decline.

On a more encouraging note, the median value of seed rounds in the first six months increased to $2.5 million from $2.2 million in each of the previous two semesters, suggesting higher investment sizes and improving seed stage valuations in the region.

This trend contrasts with companies graduating from the seed stage, where fund managers have exhibited increased caution. This is evidenced by the decline in the median value of Series A and Series B rounds, the report shows.

Down rounds and debt instruments

Fund managers interviewed for the report broadly agree that the challenging funding climate raises concerns for the remainder of the year, but they remain hopeful for a recovery in 2025.

“The VC fundraising environment in Southeast Asia has remained weak over the past three to six months, and we see startups seeking equity raises at down rounds, convertible note rounds, internal equity rounds, or other debt solutions during this period,” said Rahul Shah, Partner, EvolutionX Debt Capital.

Randolph Hsu, Founding Partner, Ondine Capital, said his team had been “significantly more cautious” this year, focusing on supporting existing portfolios due to concerns over macroeconomic conditions, geopolitical factors and uncertainties surrounding exit strategies.

Amid a challenging climate, debt financing has emerged as an alternative source of growth capital, supplementing traditional equity investments, said Quona Capital managing partner Ganesh Rengaswamy.

“Factors such as regulatory support, the rise of debt financing, and the push towards sustainable value chains continue to influence our investment decisions,” Rengaswamy said.

Separately, AppWorks chairman and partner Jamie Lin said that “for the deals being done, this is a conviction-driven climate, rather than trend- or hype-driven, in contrast to the market peak in 2021-2022.”

Lin believes that the bottom of the current correction cycle is “very close” and that the relative lack of activity is partly contrasted by rapidly improving business fundamentals across the region’s ecosystem.

Fintech shows signs of recovery, e-commerce in dire straits

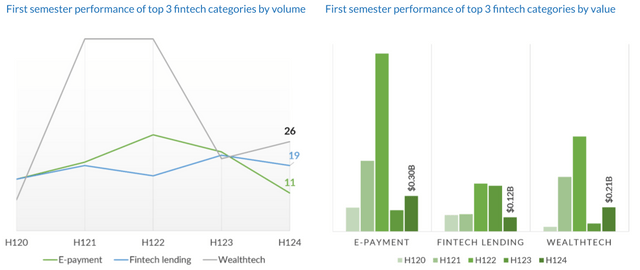

While the region is yet to emerge from the funding winter, investments into fintech startups show encouraging signs as deal flow appears to be on an upward trend in the past three quarters, driven in large part by investments into decentralised finance (DeFi) startups.

In line with the growing funding into DeFi, investments into software & IT companies focusing on blockchain solutions have reached new heights. The software & IT category maintained its position as the second most active sector after fintech, in terms of deal volume.

While the fintech space is showing early signs of recovery, the e-commerce sector has continued to lose its appeal as quarterly deal volumes have largely remained anaemic in the past four quarters.

Indonesia’s e-commerce sector, once the region’s primary investment hub, has suffered a severe decline, with local startups securing only three deals worth $10 million in the first half of this year, compared to its peak of 28 deals in H2 2021 and $651 million in H1 2021.

This downturn is due to a contraction in venture capital funding, market consolidation, and major players going public. Additionally, most publicly-listed e-commerce companies have failed to achieve profitability, leading to poor stock performance and eroding investor confidence in the sector as a whole.

Eddi Danusaputro, who leads Indonesia-focused BNI Ventures, said that while startups have made some progress in their efforts to improve business sustainability, founders must be “more realistic with regards to valuation” and see it as a bitter pill to swallow to remain attractive for funding rounds.

The SE Asia Deal Review: Q2 2024 report has extensive data on:

- Quarterly fundraising trends

- Median and average deal values across funding stages

- Deal volume and value for top sectors

- Fundraising performance of each SE Asian markets

- Perspectives from fund managers

Unlock the report for only $299 or upgrade to a Premium Plus subscription for greater savings and enjoy full access to up to 36 research reports a year, all for just $1200 ($100/month). Still not sure? Opt for a one-month trial.