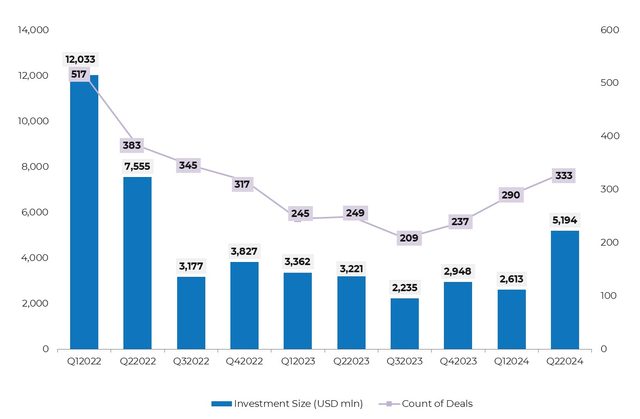

After a prolonged period of uncertainty and slowdown, startup fundraising in India touched an eight-quarter high at $5.2 billion in Q2 2024, mainly on account of a spurt in megadeals, according to data from DealStreetAsia DATA VANTAGE‘s latest report India Deal Review: Q2 2024.

The Q2 2024 proceeds marked a growth of nearly 100% over Q1 2024 when Indian startups had garnered $2.61 billion. At 333, deal volume was also up almost 15% from 290 in the previous quarter, the data showed.

On a year-on-year basis, the funding grew more than 61% from $3.22 billion in Q2 2023. The deal value rose nearly 34% from the comparable quarter last year.

In June alone, private funding for local startups crossed the $2-billion mark for the first time in two years. The local startup ecosystem had been under pressure due to a long-drawn funding winter that began in the latter half of 2022 as a result of global economic uncertainties, market volatility, and a tightened monetary environment.

About 11 megadeals—transactions worth at least $100 million—were closed in Q2 2024 as against three in Q1 and nine in the comparable quarter last year. The share of megadeals in overall funding increased to 47.5% in the April-June quarter as against 12% in the previous quarter.

The average deal size, among disclosed deals, in Q2 2024 almost doubled to $18.5 million from $10.2 million in the previous quarter and was 20% higher than in Q2 2023. This was the highest average deal size recorded by Indian startups in eight quarters and came quite close to the levels seen in 2022 when deal activity was at its peak.

In the first six months of 2024 (H1), startups raised $7.8 billion in funding—a 16% year-on-year increase. Deal volume in H1 2024 was also up 26% year-on-year.

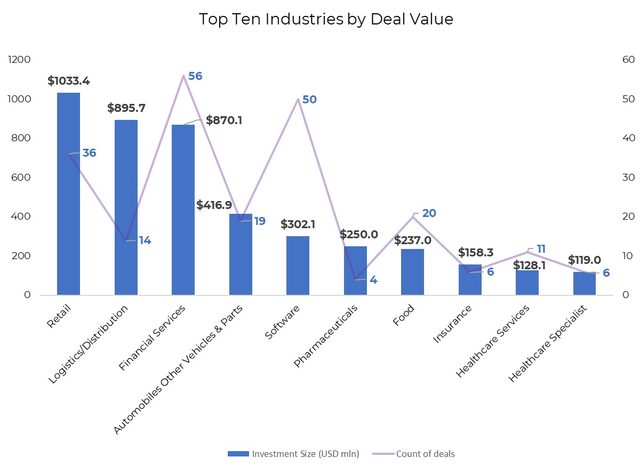

Retail grabs lion’s share

Retail, which includes both offline and online commerce, emerged as the top fundraiser in Q2 2024, with total proceeds of $1.03 billion. The industry had raised a mere $167.3 million in the previous quarter from 25 transactions. Flipkart led the industry with $350 million in funding from Google; followed by Meesho, which secured $275 million in a new funding round.

Buoyed by grocery delivery startup Zepto’s $665-million funding round, the logistics and distribution industry was pushed to the second spot with a total $895.7-million funding from 14 deals.

Financial services, which occupied the top spot in Q1, slipped to third place in Q2 with total proceeds of $870 million from 56 deals. Digital lending startup Fibe, formerly known as EarlySalary, was the industry’s largest fundraiser in Q2, with a $90-million Series E funding round.

Broken down by verticals, e-commerce pipped fintech lending to emerge as the most funded vertical with total proceeds of $2.18 billion from 70 transactions. E-commerce startups had raised $457 million across 56 transactions in Q1 and $480.5 million in funding across 50 transactions in the comparable quarter last year.

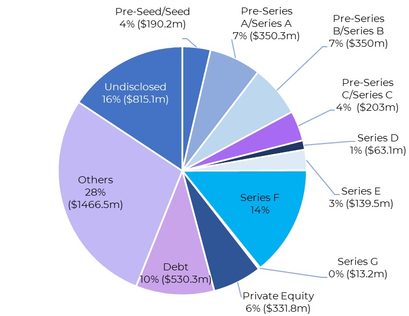

Growth-stage deals lead the pack

Growth-stage startups accounted for the biggest chunk of private capital secured in Q2. Companies at Series B and later stages (including private equity and pre-IPO companies) collected an aggregate of $2.2 billion from 46 deals, against $1.3 billion from 52 transactions in Q1.

During the month, prominent growth-stage deals were inked by Zepto, Flipkart, Pharmeasy, Kitchens@, Fibe, NephroPlus, Ummeed Housing Finance, Bira 91, Atlan, Battery Smart, and Altum Credo, among others.

Pre-Series A and Series A deals raised $350.3 million in Q2, registering an increase of about 31% over the previous quarter. The volume of such deals, too, increased to 76 from 66 in Q1. Pre-seed and seed-stage deals cumulatively raised $190 million in Q2, registering an increase of 14% from Q1. Meanwhile, debt investments more than doubled to $530 million in Q2.

Bengaluru, Mumbai, and Gurugram continued to be the top three destinations for venture investments in India in Q2. Bengaluru took the lead with investments worth $1.45 billion across 95 transactions, registering a growth of 24.5% in value over Q1. The top three cities closed 194 transactions worth $3.5 billion, or 67.6% of all deal value across cities.

Venture Catalysts, along with its early-stage startup fund 100Unicorns (formerly 9Unicorns), was the top investor in Q2 with at least 17 investments. Inflection Point Ventures occupied the second spot with 14 investments in the April-June quarter as against 12 in Q1.

The India Deal Review: Q2 2024 report has extensive data on:

- Top deals of Q2 2024

- Top sectors by fundraising

- Megadeals clocked by startups in Q2

- Most active investors in Q2

- Insights from prominent investors

The report is available exclusively to DealStreetAsia – DATA VANTAGE subscribers. Subscribe/upgrade your subscription now to access our entire set of reports.