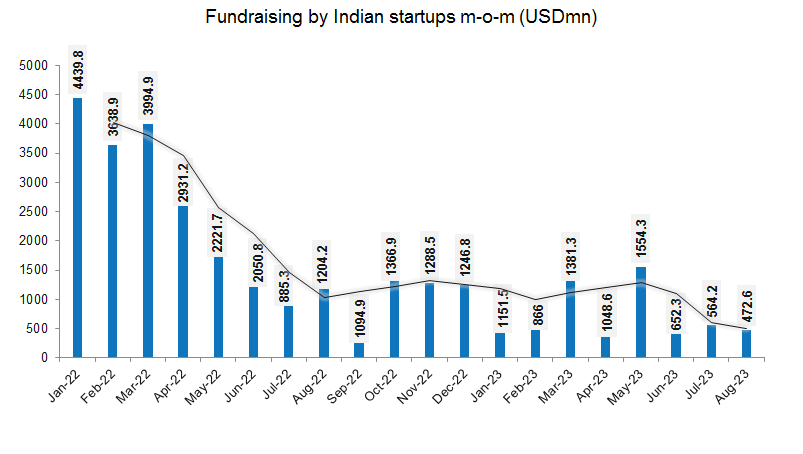

India Deals Barometer Report: Startup funding drops to $473m in Aug—the lowest since June 2020

Startup investments in India continued to move south in August as risk capital investors pulled back significantly on funding amid growing market uncertainties. The only silver lining in the month was the minting of Zepto as the country’s first unicorn in nearly a year.

Indian startups raked in $473 million across 59 venture capital and private equity transactions in August, down 16% from July when companies had collectively scooped up $564 million, according to proprietary data compiled by DealStreetAsia.

This marks the lowest investment since the pandemic-hit June 2020 when startups in the country could collect only $416 million from investors as economic activity froze globally.

The deal volume in August was also down 25% to 59 from 76 in the previous month, the data showed.

On a year-on-year basis, the fall in deal value (60.7%) was more stark as investors had pumped in $1.2 billion across 113 transactions in August 2022. The lower net capital inflow compared with the same period last year is a sign of subdued investor sentiment amid the global economic slowdown.

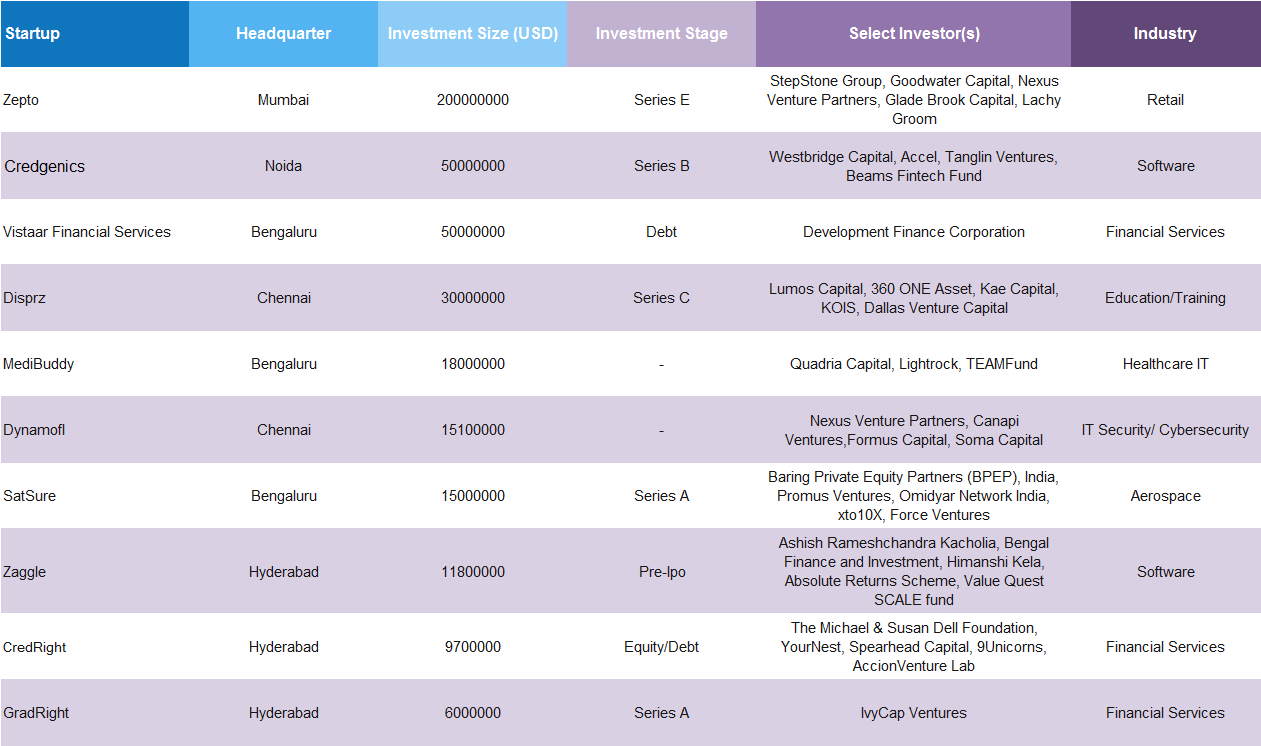

Top 10 venture deals in India (August 2023)

Zepto, the quick commerce startup that joined the $1-billion-valuation club, was the top fundraiser in August.

Mumbai-based Zepto raised $200 million in a Series E funding round led by StepStone Group at a $1.4 billion valuation. Goodwater Capital also joined the round as a new investor while existing investors, like Nexus Venture Partners, Glade Brook Capital, and Lachy Groom also participated.

Unicorn creation has been declining sharply in India. There were 24 private startups that topped the billion-dollar valuation mark in 2022, down from the record of 45 in 2021. Prior to Zepto, Goa-based Molbio Diagnostics had bagged the unicorn tag in September 2022 after raising $85 million in a funding round led by Singapore state investor Temasek.

Zepto’s $200-million deal was also August’s only mega deal, which is defined as a transaction worth at least $100 million. Other prominent deals included debt collection platform Credgenics ($50 million), fintech lender Vistaar Financial Services ($50 million), and enterprise skilling platform Disprz ($30 million), and healthtech startup MediBuddy ($18 million).

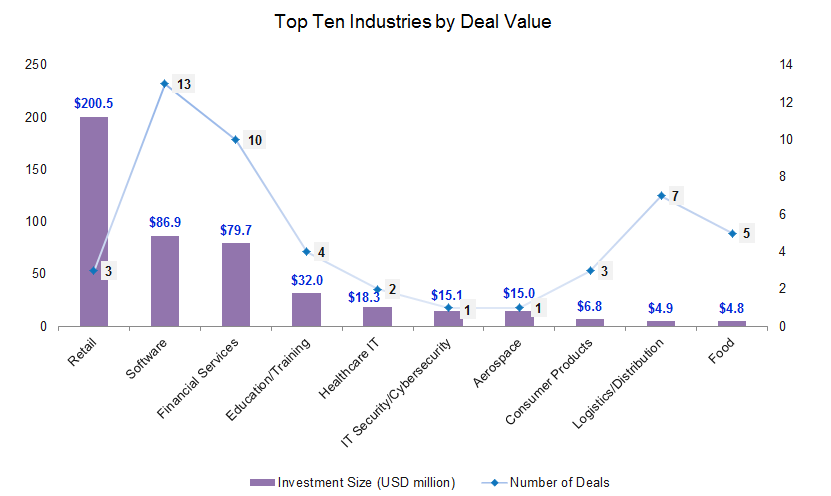

Retail startups top in deal value

Buoyed by Zepto, retail emerged as the most funded industry in August. Retail startups cumulatively bagged $200.5 million in financing from only three deals. In comparison, retail startups had raised $53.1 million across eight transactions in July.

Software startups followed with total investments worth a combined $86.9 million across 13 deals. Within software, debt recovery and legal automation platform Credgenics raised the largest round of $50 million led by Westbridge Capital and Accel. The round also saw the participation of Tanglin Ventures, Beams Fintech Fund and other strategic investors.

Meanwhile, there were 10 deals worth a combined $79.7 million in the financial services sector led by Vistaar Financial Services, which received $50 million in funding from the US government’s development finance institution International Development Finance Corporation (DFC).

Other deals within financial services included CredRight ($9.7 million), GradRight ($6 million), CheqUPI ($5 million), and Stable Money ($5 million).

Together, the top three industries—retail, software, and financial services—raised $367 million, accounting for 78% of the total deal value.

Early-stage deals show resilience

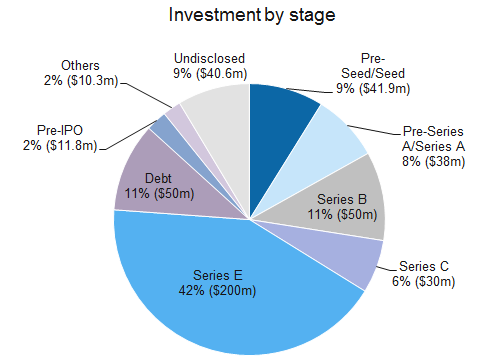

Pre-seed and seed-stage deals led volumes in August. The 32 deals in these stages accounted for about 54% of the deal volume. These startups together scooped up about $41.9 million, which is higher than the $29.8 million funding secured in July. Stable Money, Kombai, Wootz.work, Neurowyzr, Portkey.ai, and Weekday were among those who raised seed rounds in August.

Startups in the pre-Series A and Series A stages raked in about $38 million across 11 transactions, which marked a drop of 74% in value over July. Spacetech startup SatSure raised the largest round of $15 million led by Baring Private Equity Partners India and Prosmus Ventures. GradRight ($6 million), Unstop ($5 million) and SuperBottoms ($5 million) were among the other disclosed Series A deals in the month.

In terms of value, growth-stage startups led fundraising in August. Companies in the Series B or post-Series B rounds (including private equity rounds) collected an aggregate of $280 million through three transactions, accounting for about 59% of the deal value in the month. This is 17% lower compared to $337 million worth of growth-stage deals closed in July. The prominent growth-stage deals in the month included Zepto ($200 million), Credgenics ($50 million), and Disprz ($30 million).

Top Investors

Startup investing platform WeFounderCircle and its startup accelerator EvolveX together made a total of seven investments, the highest in the month. Together they led funding in car servicing startup CarEasy, while EvolveX was also a lead investor in fintech startup Rupid and jewellery savings app Plus.

Angel investing platform Inflection Point Ventures (IPV), and Venture Catalysts along with its accelerator platform 9Unicorns occupied the second spot with five investments each.

IPV led investments in Wallter Systems, BizPay, 13SQFT, ShipEase, and MetaShot. In June, the venture firm announced that it made 12 exits from its portfolio companies in 2022, giving an internal return rate (IRR) of 160% to its investors. Some of the key exits included high-performing startups like BluSmart, Otipy, Stage, and Buyofuel.

Venture capital firms Matrix Partners India and Nexus Venture Partners made three investments each.

Edited by: Pramod Mathew

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup fundraising scales six-month peak at $5.1b in Aug

August proved to be a record month for dealmaking in the Greater China market, as startups sealed 257 venture deals — the highest so far this year in terms of deal count.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising dives 72% to $486m in Aug

Dealmaking in Southeast Asia dropped by nearly 72% month-on-month in August to just about $486 million...