China Deals Barometer Report: Startup fundraising dips a tad in Sept as deal volume falls

Startup fundraising in the Greater China region slowed a tad in September as fewer deals were sealed in the month.

Almost $4.8 billion was invested in startups from mainland China, Hong Kong, Macau, and Taiwan across 208 deals in September. The deal value was down around 6% from August’s $5.1 billion, while the deal count dropped by 19.1% in the same period, show proprietary data compiled by DealStreetAsia.

Yet, dealmaking remained elevated compared with year-ago levels when the deal value was 18% less.

Investors have so far tightened their purse strings this year, as economic and geopolitical headwinds continue to linger. In the first nine months of 2023, a total of $39.8 billion was invested across 1,923 deals. The combined deal count was 16% more than the same period last year but the deal value showed only a negligible 2.7% growth.

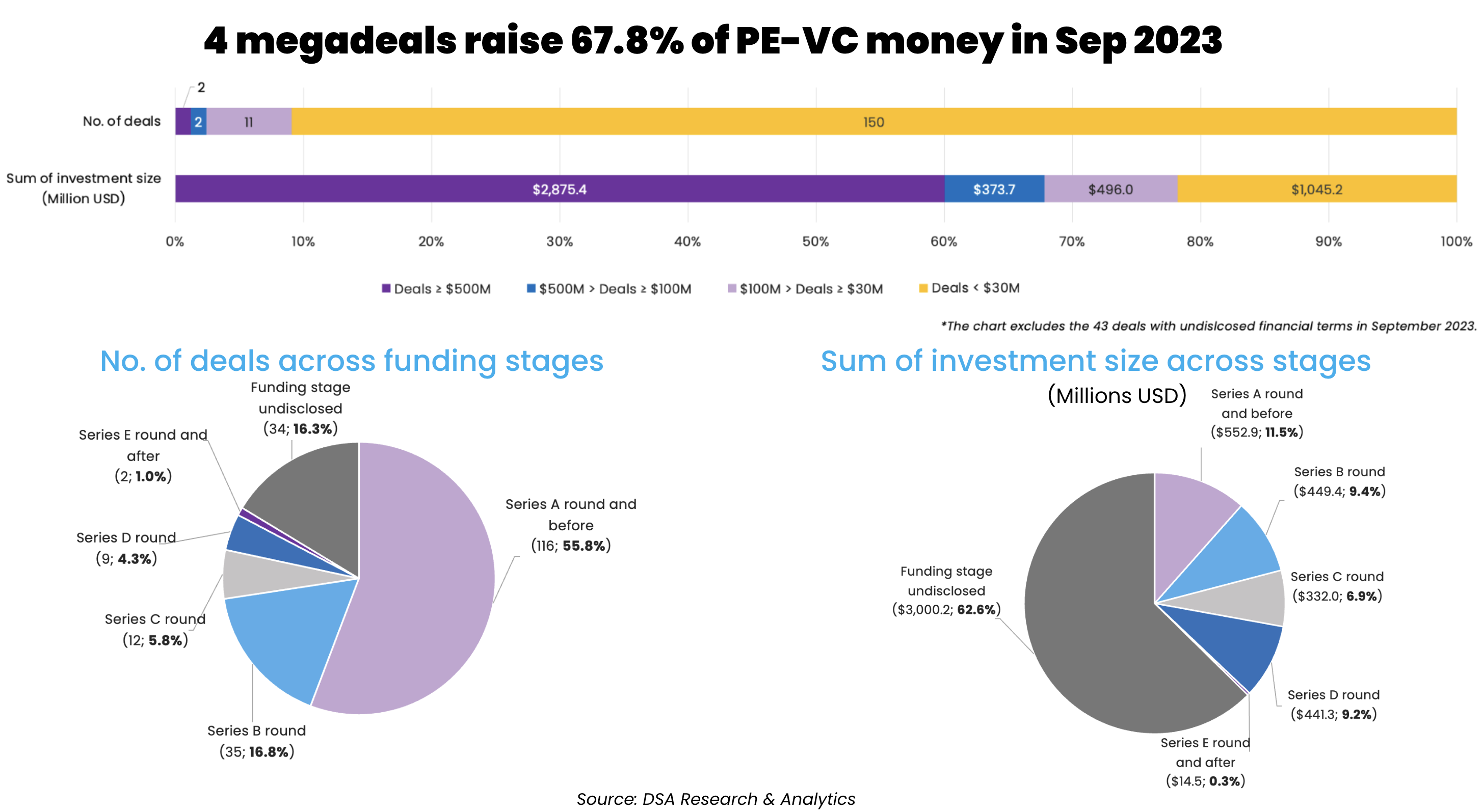

Two billion-dollar deals prop up fundraising in Sept

September saw two billion-dollar deals that contributed to 60% of the month’s total financing.

Shanghai-based automotive chipmaker GTA Semiconductor was the largest fundraiser of September, snapping up 13.5 billion yuan ($1.8 billion) from a slew of state-affiliated funds and institutional investors.

Intelligent vehicles manufacturer ROX Motor, also a Shanghai-based firm backed by Tencent and Coatue Management, secured $1 billion from textile and aluminium manufacturing giant Weiqiao Pioneering Group, in the second-largest deal of the month.

These were among the four megadeals, or transactions worth at least $100 million, in September. This is the lowest megadeal count of the year, after April and May when five megadeals each were sealed.

The other two megadeals were by Tencent-backed artificial intelligence (AI) chipmaker Enflame Technology, which bagged 2 billion yuan ($273.7 million) in a Series D funding round,

The round was co-led by a few funds backed by Shanghai International Group, a state capital operator that manages 140 billion yuan ($19.2 billion) in assets; while Chinese photo editing app owner Meitu and Tencent Holdings, which has worked with Enflame in developing an AI chip called “Zixiao” for processing images, videos, and natural languages, joined the round.

In another megadeal, medical device developer MitrAssist, which was founded in Israel and is now expanding in China, secured almost $100 million in a Series C round led by two of its existing shareholders: Centurium Capital and 6 Dimensions Capital.

The four megadeals raised a combined $3.2 billion, which is 67.8% of the total PE-VC funding in September.

Deals by funding stage

Investments in Series A and earlier stages accounted for 55.8% of the total deal count but contributed only 11.5% ($552.9 million) of the monthly deal value.

There were 34 investments with undisclosed funding stages. While that comprises only 16.3% of September’s deal count, they accounted for 62.6% of the total deal value, or $3 billion, as two of the billion-dollar deals did not disclose their funding stages.

Dealmaking was far less active in funding stages closer to public listing. The month logged two deals in Series E stages and later that brought in around $14.5 million in funding. Exits via public listings, either on domestic or overseas bourses, have shown signs of a slowdown amid rising regulatory scrutiny against IPO hopefuls, leading to slackened investor sentiment towards growth- and late-stage firms.

List of megadeals (September 2023)

Startup Headquarters Investment size (Million USD) Investment stage Lead investor(s) Other investor(s) Industry/Sector Vertical

GTA Semiconductor Shanghai 1875.4 Jasper Capital Semiconductor Electric/Hybrid Vehicles

ROX Motor Shanghai 1000 Strategic Investment Weiqiao Pioneering Group Automobiles & Parts Electric/Hybrid Vehicles

Enflame Technology Shanghai 273.7 D Funds affiliated with Shanghai International Group Meitu, Tencent Holdings, SummitView Capital, YTI Capital, and others Semiconductor AI and Machine Learning

MitrAssist Shanghai 100 C Centurium Capital, 6 Dimensions Capital Shanghai Jiading District State-Owned Asset Operation Group, Haiheng Capital, Hefei Industrial Investment Capital, and others Medical Devices & Equipment HealthTech

Semiconductor is king

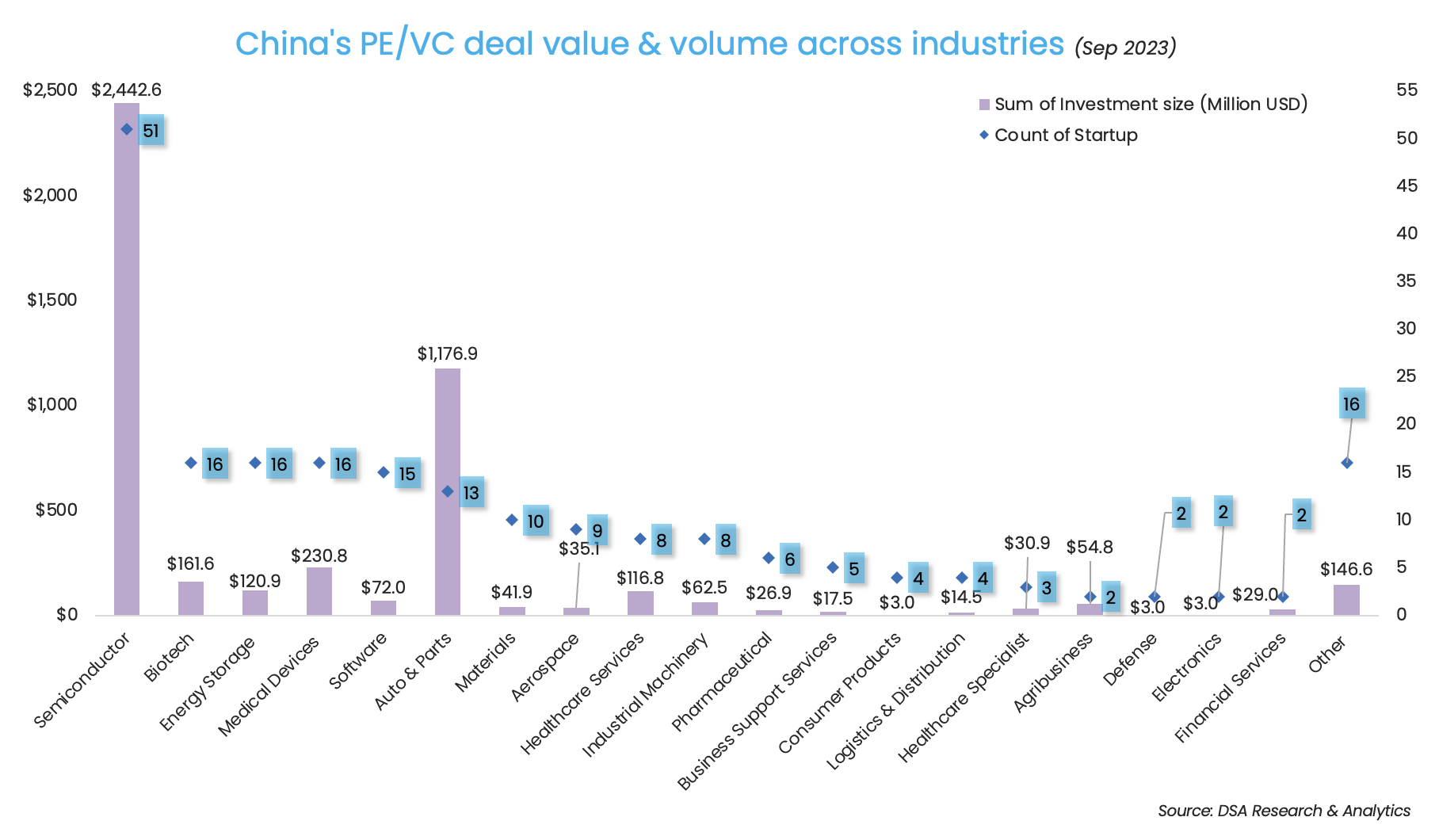

Chip-making firms have continued to see demand as the country strives for self-reliance in chipmaking amid an intensifying US crackdown on Chinese companies in the sector. Unsurprisingly, semiconductor was the most funded industry in September, sealing 51 deals and raising $2.4 billion.

State-affiliated investors have been one of the main backers of startups in the sector. China is set to raise about $40 billion for a new state-backed investment fund dedicated to the local semiconductor industry, Reuters reported in early September, citing two people familiar with the matter.

However, geopolitical tensions will continue to play a role in the global development of the semiconductor industry. Although the immediate impact will be subtle, major industry players will adopt long-term strategies to focus more on supply chain self-reliance, security, and control, commented Helen Chiang, IDC’s Asia Pacific semiconductor research lead and Taiwan country manager, in the firm’s latest report on the impact of geopolitics on Asia’s semiconductor supply chain.

Biotech, energy storage, and medical devices were the second-most invested sectors as the three completed 16 deals each. However, thanks to ROX Motor’s billion-dollar transaction, automobiles and parts ranked as the second top raiser in terms of deal value, with the completion of 13 deals worth over $1.2 billion.

SDIC Venture Capital and its affiliates top investor list

State Development & Investment Corporation (SDIC), one of China’s largest state-owned investment holding companies, and its affiliates, invested $135.8 million across six deals, making it the top fundraiser of the month.

The second-most active investor by deal count was Shenzhen High-Tech Investment Group and CICC Capital—both state-affiliated investors that invested in four deals separately.

The month also saw more China-focused venture capital firms bidding farewell to its Silicon Valley lineage amid intensifying geopolitical tensions. BlueRun Ventures China, announced a change of its English name to ‘Lanchi Ventures’ in a bid to assert that its operations are independent of US-based VC firm BlueRun Ventures (BRV). Meanwhile, GGV Capital spilt its businesses into two, with one dedicated to Asia and the other to the US.

Most active investors in China (September 2023)

Investment company No. of deals Total value of participated deals (Million USD) Lead Non-lead

SDIC Venture Capital and its affiliates 6 135.8 5 1

Shenzhen High-Tech Investment Group 4 31.9 2 2

CICC Capital 4 139 4 0

SAIC Motor Corp and its affiliates 3 29 1 2

China Fortune-tech Capital 3 16 1 2

Guiyang Venture Capital 3 43.5 1 2

Hecheng Capital (和诚资本) 3 4.5 1 2

Hefei Industry Investment Group 3 96.3 1 2

Addor Capital 3 11.4 2 1

Z&Y Capital 3 29 0 3

Goldport Capital 3 4.5 3 0

Tsinghua Capital 3 3 3 0

Cowin Capital 2 16 2 0

Note: In our monthly analysis for September 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Megadeals lift startup funding to $1.1b in Sept—up 126% from Aug

Startups based in Southeast Asia raised $1.1 billion in September, up 126% from August, and marking the third time this year that fundraising has crossed the $1-billion mark

India Deals Barometer Report: Fundraising by startups bounces back to touch $1.2b in Sept

Fundraising in India bounced back in September after a lull of almost three months, with startups amassing nearly $1.2 billion across 74 private equity and venture capital transactions...