Greater China Deals Barometer Report: Startup funding shows signs of recovery in July as deal count grows

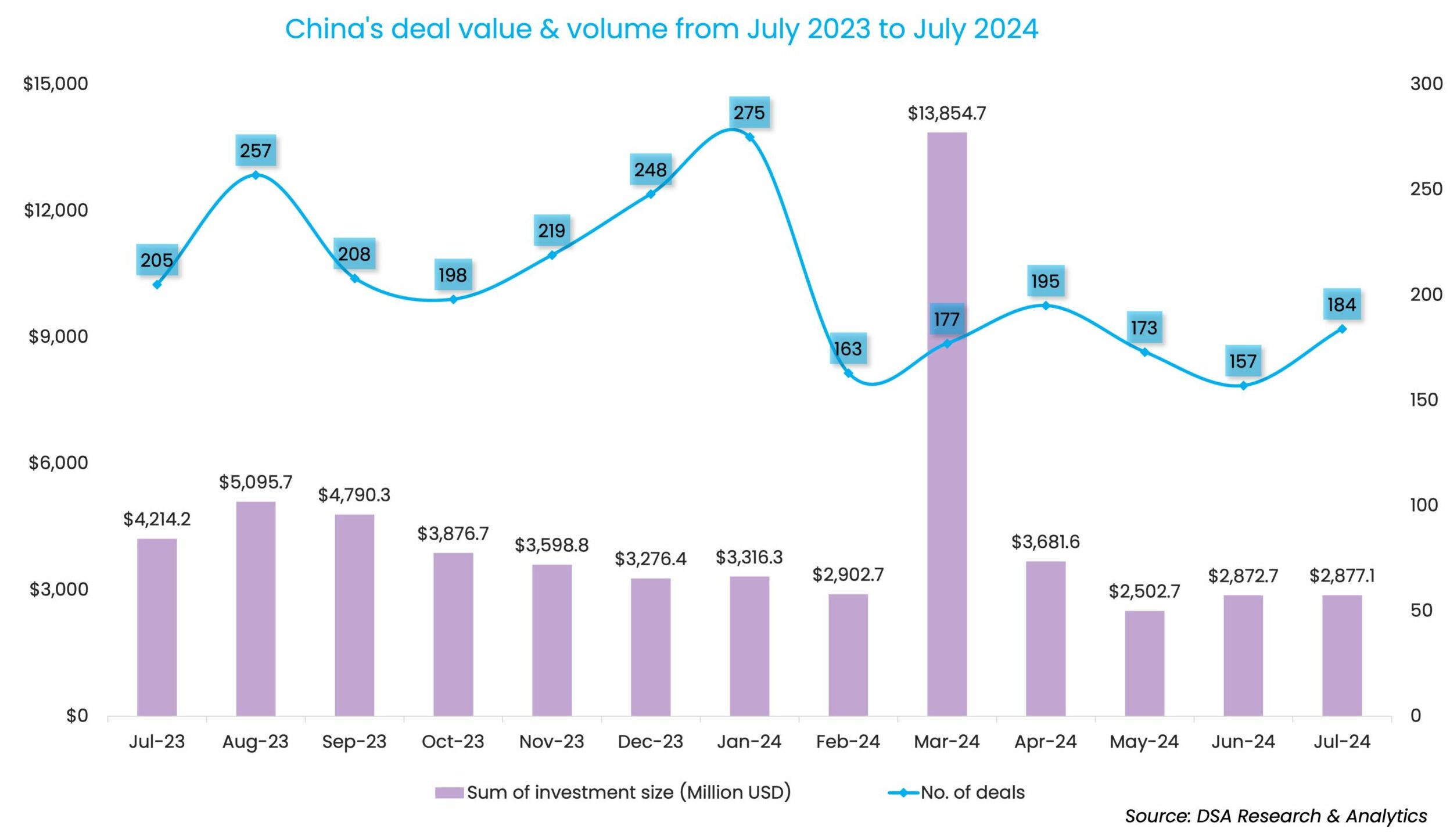

Investors ramped up transactions in July as the Greater China market closed 184 deals, up 17.2% from June. The deal count, which hit a three-month high, shows signs of revival after the 9.2% month-over-month decline in deal volume in June.

At almost $2.9 billion, the monthly deal value was on par with the previous month, according to proprietary data compiled by DealStreetAsia.

Despite the signs of a rebound, the venture funding scene is still far from the peak achieved a year before. The deal value in July 2024 logged a 32% drop from the same month last year, while the deal count slipped 10.2%.

The good news is that a gradual recovery is underway. The first seven months of 2024 saw the completion of 1,458 deals raising almost $29.9 billion. Venture investors committed 7.1% more capital during the said period, although the deal count was 9.2% less than the same time last year.

GenAI in top gear

Chinese generative artificial intelligence (GenAI) startup Baichuan Intelligent Technology snapped the biggest venture deal of the month, making it the only megadeal that secured over $500 million in funding in July.

The GenAI firm pocketed 5 billion yuan ($691.4 million) in a Series A funding round, as the firm expands the use cases of its large language models (LLMs) amid intense domestic competition, roping in Chinese internet juggernauts including the likes of Alibaba Group, Tencent Holdings, and Xiaomi Corp, as well as two state-affiliated investors.

The GenAI frenzy, which was started by ChatGPT in November 2022, has since led to several Chinese names including MiniMax, Moonshot AI, and Zhipu AI racing to launch their large language models (LLMs) and snap up mega funding from investors.

However, investors have warned that consolidation is inevitable, alongside a rising cautious sentiment towards the hype as AI chip shortage and geopolitical tension continue to drag on the industry.

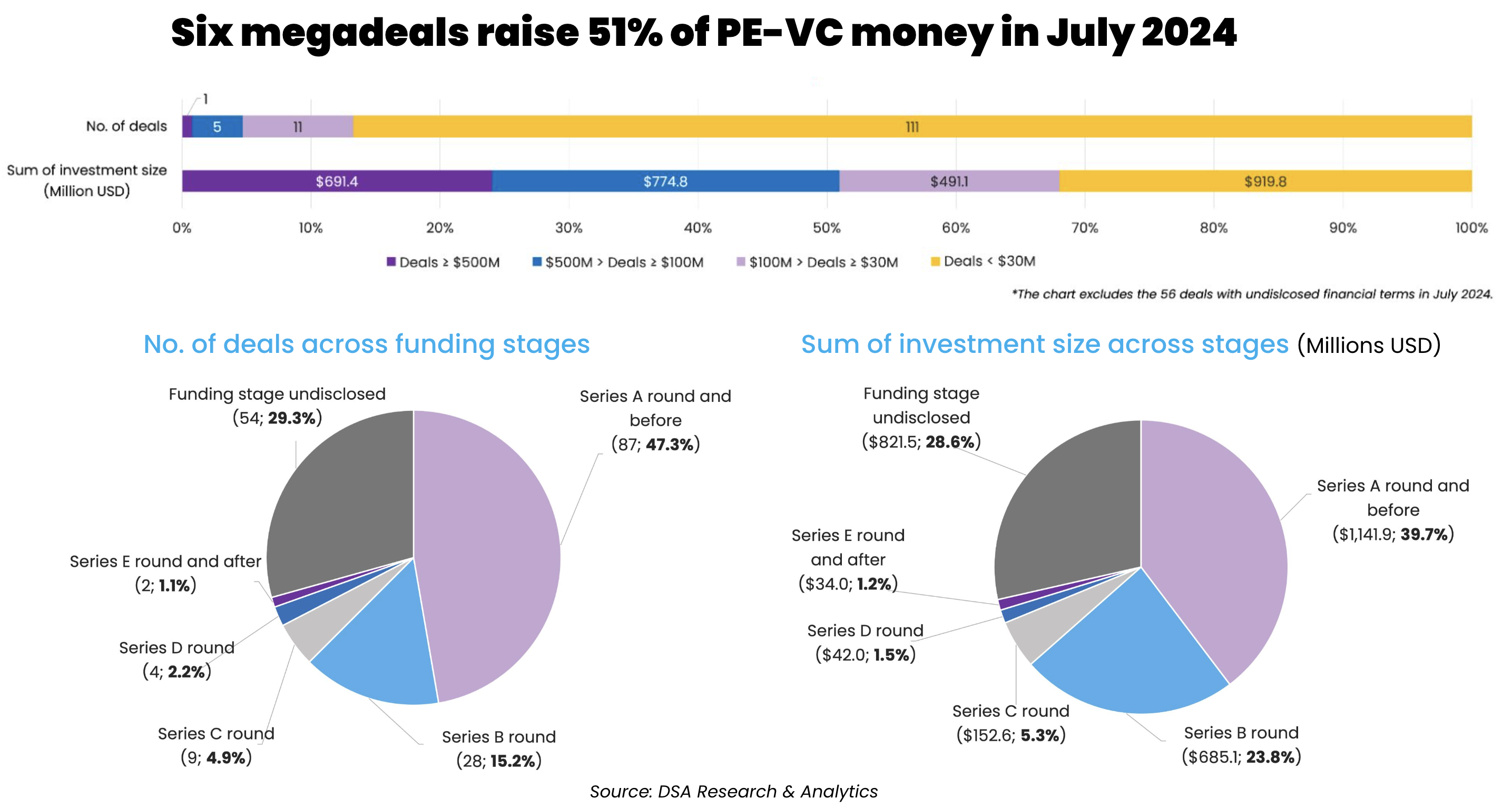

Despite the scarcity of billion-dollar deals, Baichuan’s investment was part of the six megadeals —investments worth at least $100 million— that took place in July. The remaining five deals were completed in pharmaceutical, space tech, energy storage, automobile, and semiconductor, aligning with the country’s pursuit of becoming a deep tech powerhouse.

At 87 deals, early-stage investments continued to dominate the country’s venture scene, accounting for 47.3% of the total deal count while collectively raising $1.1 billion, or 39.7% of the total startup funding.

At 87 deals, early-stage investments continued to dominate the country’s venture scene, accounting for 47.3% of the total deal count while collectively raising $1.1 billion, or 39.7% of the total startup funding.

In contrast, late-stage dealmaking activity recorded only two deals at Series E or later stages. Intelligent manufacturing company Keber Technology was the only firm that raked in pre-IPO funding, roping in carmaker SAIC Motor-affiliated Shang Qi Capital among its investors.

Analysts have recently predicted that Hong Kong’s IPO market could recover in the second half of 2024, while the A-share IPO activity would remain muted in the short term. According to a PricewaterhouseCoopers report, around 80 companies will list in Hong Kong in 2024 and hit a fundraising level of HKD 70 to 80 billion. That could bode well for the late-stage dealmaking scene going forward.

List of megadeals (July 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Baichuan Intelligent Technology/Baichuan AI | Beijing | 691.4 | A | Alibaba Group, Tencent Holdings, Xiaomi Corp, Beijing Artificial Intelligence Industry Investment Fund, Shanghai Artificial Intelligence Investment Fund, Shenzhen Capital Group | Business Support Services | AI and Machine Learning | ||

| Luye Pharma (Shenzhen) | Shenzhen | 220 | Shenzhen Investment Holdings Capital | Pharmaceutical | Biotech | |||

| Deep Blue Aerospace | Nantong | 139.7 | B2 | Wuxi Hi-Tech District Venture Capital Investment Group | Aerospace | Space Tech | ||

| Zenergy Battery Technologies Group | Changshu | 139.7 | B | Changshu SINOGY Venture Capital, Dongnan Investment Holding, Suzhou Suchuang Energy Investment | Energy Storage & Batteries | Electric/Hybrid Vehicles | ||

| SemiDrive Technology | Beijing | 137.7 | Strategic Investment | Beijing Economic-Technological Development Area, People’s Government of Beijing Manicipality | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| ICleague Technology | Haining | 137.7 | Yes | B | Accurate Capital, Optics Valley Industrial Investment, CMB International, Puhua Capital, Cherami Investment Group | Semiconductor | N/A |

Pharma deal in limelight

July saw the completion of one rare megadeal in the pharmaceutical sector, despite an ongoing venture funding slowdown in the sector. State-owned Shenzhen Investment Holdings Capital has agreed to invest up to 1.6 billion yuan ($220 million) into a wholly-owned subsidiary of Hong Kong-listed Luye Pharma Group as part of the latter’s plan to boost its oncology drug business.

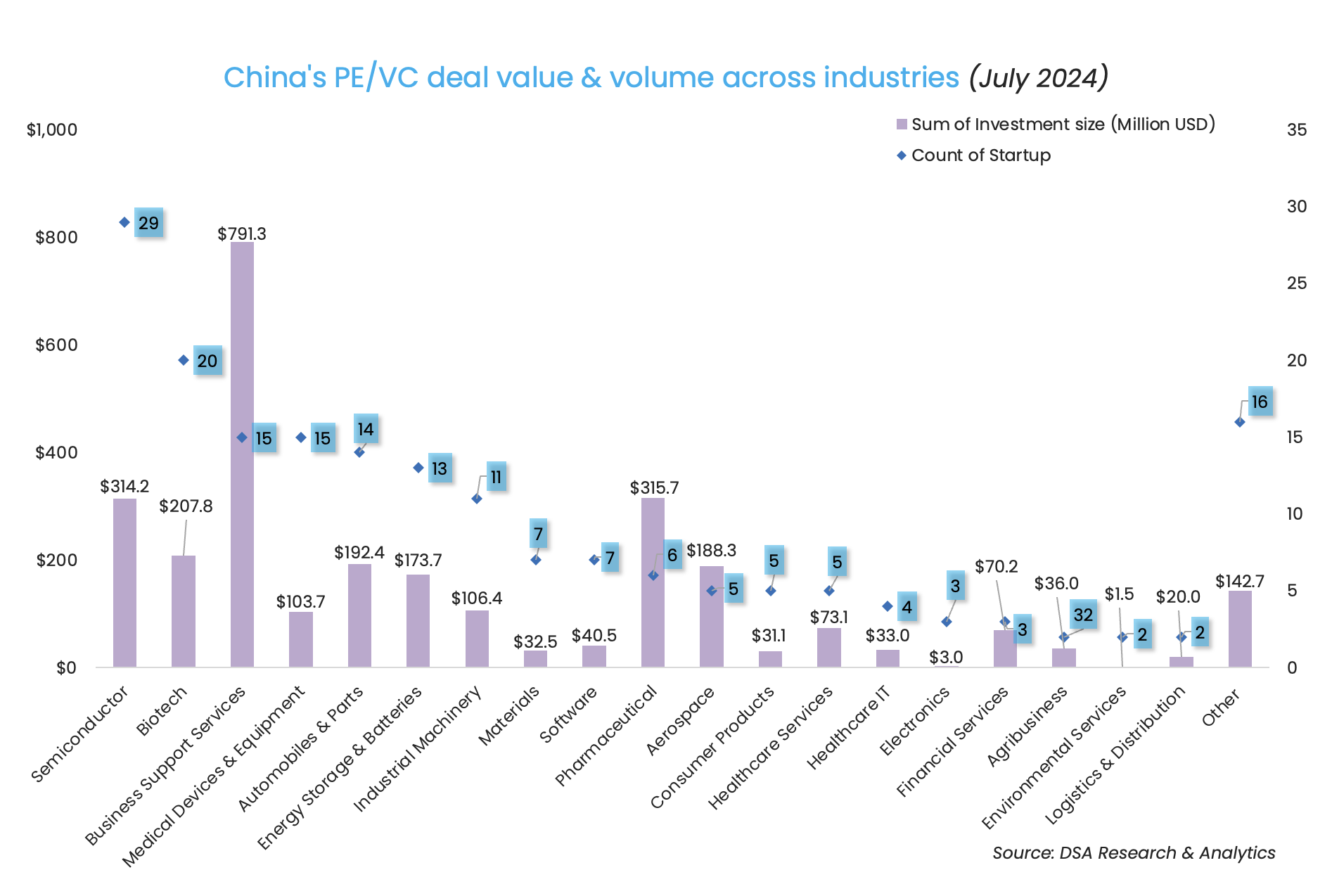

Besides the rare megadeal in the pharmaceutical sector, the month saw semiconductor and biotech take the lead in deal count, with the completion of 29 and 20 transactions respectively.

Chinese chipmaker ICleague Technology was the largest deal in the semiconductor sector, securing “several billions of yuan” in a Series B funding round; while MoonBiotech, which develops microbial products, bagged 300 million yuan ($41.3 million) in an extended Series C funding round to become the largest biotech deal of the month.

SDIC Venture Capital tops investor list

State Development & Investment Corporation (SDIC), one of China’s largest state-owned investment holding companies, and its affiliates, invested $97.3 million across eight deals, making it the top fundraiser of the month.

Puhua Capital was the second-most active investor by deal count. Founded in 2004, the Hangzhou-headquartered venture capital investment firm, which counts the likes of Tiktok-owner Bytedance, autonomous driving firm Pony.ai, and solar technology developer Anhui Huasun Energy among its portfolio companies, manages over 27 billion yuan ($3.8 billion) in assets, as of April 10.

Most active investors in China (July 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| SDIC Venture Capital & affiliates | 8 | 97.3 | 5 | 3 |

| Puhua Capital | 6 | 163 | 3 | 3 |

| SAIC Motor & affiliates | 4 | 28 | 1 | 3 |

| Qiming Venture Partners | 4 | 98.7 | 2 | 2 |

| E-town Capital | 4 | 48.9 | 1 | 3 |

| ECC Capital | 4 | 0 | 4 | 0 |

| CAS Star | 4 | 15.5 | 1 | 3 |

| Chengdu science and technology innovation investment group | 3 | 0 | 0 | 3 |

| CMG-SDIC Capital | 3 | 28 | 2 | 1 |

| Industrial Securities Capital | 3 | 0 | 0 | 3 |

| Legend Holdings & affiliates | 3 | 28 | 1 | 3 |

| CoStone Capital | 3 | 18.3 | 3 | 0 |

| Glory Ventures | 3 | 43 | 1 | 2 |

| CICC Capital | 3 | 42 | 1 | 2 |

| Oriza Seed | 3 | 17 | 1 | 2 |

| FreesFund | 3 | 22.4 | 1 | 2 |

| CDH Investments | 3 | 50.9 | 0 | 3 |

Note: In our monthly analysis for July 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup fundraising falls 17% MoM in July

Startup fundraising remained subdued in Southeast Asia in July due to the absence of large-ticket deals. At $504 million, the value of funding deals in the region last month was down 17% from June, according to proprietary data compiled by DealStreetAsia. There were 53 deals in the month, compared with June's 46 transactions.

Venture Capital

India Deals Barometer Report: Startup funding tanks 52% to $1b in July

After witnessing a sharp uptick in June this year, private equity and venture capital funding for Indian startups plummeted almost 52% to $1 billion in July, according to data compiled by DealStreetAsia. Startup funding crossed the $2-billion mark for the first time in two years in June.